Essay:Cyberlaundering: Anonymous Digital Cash and Money Laundering: Difference between revisions

No edit summary |

No edit summary |

||

| Line 17: | Line 17: | ||

While change is often a frighteningly awkward experience, for an enterprising criminal operation, that wishes to remain open for business, it is a necessity. As the above mentioned race through laundering history demonstrates, creativity, and not necessarily greed, has been the launderer's salvation. The recent explosion of Internet access<ref>Twenty-five million Americans had Internet access in early 1995. ''See'' Legal Issues in the World of Digital Cash, ''available online at'' URL: http://www.info-nation.com/cashlaw.html/.</ref> may be the new type of detergent which allows for cleaner laundry. | While change is often a frighteningly awkward experience, for an enterprising criminal operation, that wishes to remain open for business, it is a necessity. As the above mentioned race through laundering history demonstrates, creativity, and not necessarily greed, has been the launderer's salvation. The recent explosion of Internet access<ref>Twenty-five million Americans had Internet access in early 1995. ''See'' Legal Issues in the World of Digital Cash, ''available online at'' URL: http://www.info-nation.com/cashlaw.html/.</ref> may be the new type of detergent which allows for cleaner laundry. | ||

==Part II ''Enter, Anonymous Ecash''== | |||

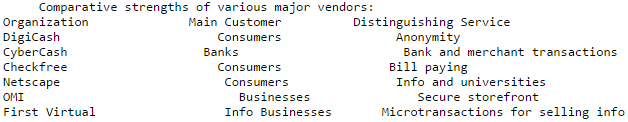

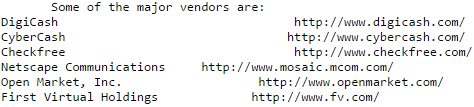

In the virtual universe of cyberspace the demand for efficient consumer transactions has lead to the establishment of electronic cash.<ref>Electronic Cash, digital cash, digital currency and cybercurrency are synonyms for an electronic medium of exchange which has no intrinsic value, and the barest trace of physical existence. ''See'' Daniel C. Lynch & Leslie Lundquist, Digital Money: the new area of Internet commerce, 1996 at 99.</ref> Electronic cash, or digital money, is an electronic replacement for cash.<ref>Id. at 99.</ref> Digital cash has been defined as a series of numbers that have an intrinsic value in some form of currency.<ref>David Cline, Term Paper, ''Cryptographic Protocols for Digital Cash'', George Washington University, School of Engineering and Applied Science (Computer Security I). ''Available online at'' URL: http://www.seas.gwu.edu/student/clinedav/.</ref> Using digital cash, actual assets are transferred through digital communications in the form of individually identified representations of bills and coins - similar to serial numbers on hard currency.<span style="font-size:0px;"><ref> Information Infrastructure Task Force, The Report of the Working Group on Intellectual Property Rights, Intellectual Property on the National Information Infrastructure, 193 (Sept. 1995). ''Available online at'' URL: http://www.uspto.gov/web/ipnii (PDF format); and URL: gopher://ntian1.ntia.doc.gov:70/00/papers/documents/files/ipnii.txt (ASCII format). {{error||Citenote missing in original document}}</ref></span><ref>''See'' Lynch & Lundquist, ''supra'' note 23 at 24, table 2.1.<br/>[[File:Cyberlaundering table 1.png|link=]]</ref> While the ultimate goal of each vendor is to facilitate transactional efficiency, bolster purchasing power on the Internet, and, of course, earn substantial profit in a new area of commerce, each vendor plays by slightly different rules.<ref>''See'' Lynch & Lundquist, ''supra'' note 23 at 37, table 2.2.<br/>[[File:Cyberlaundering table 2.png|link=]]</ref> Although the intricacies of individual vendors are quite fascinating, for the purpose of this article, it is fair to say that all but one vendor have one trait in common: lack of anonymity. | |||

The exception to the general rule of lack of anonymity is DigiCash.29 Digicash is an Amsterdam-based company created by David Chaum,30 a well respected cryptologist. DigiCash's contribution to Internet commerce is an online payment product called "ecash."31 According to DigiCash, electronic cash by DigiCash "combines computerized convenience with security and privacy that improve on paper cash."32 Ecash is designed for secure payments from any personal computer to any other workstation, over e-mail or Internet.33 In providing security and privacy for its customers, DigiCash uses public key digital blind signature techniques.34 Ecash, unlike even paper cash, is unconditionally untraceable. The "blinding" carried out by the user's own device makes it impossible for anyone to link payment to payer. But users can prove unequivocally that they did or did not make a particular payment, without revealing anything more.35 While ecash's security technology may be among the best in the business as of this writing, the focus of this article is upon one aspect of DigiCash that is of particular interest to money launderers and law enforcement: Anonymity. | |||

==Endnotes== | ==Endnotes== | ||

These are essential to fully understand the article! | These are essential to fully understand the article! | ||

<references/> | <references/> | ||

[[Category:Pre-Bitcoin essays]] | |||

[[Category:1996 essays]] | |||

Revision as of 20:00, 14 July 2015

| Author(s) | Bortner, Mark |

| Published | 1996 |

This article will explore the latest technique in money laundering: Cyberlaundering by means of anonymous digital cash. Part I is a brief race through laundering history. Part II discusses how anonymous Ecash may facilitate money laundering on the Intenet. Part III examines the relationship between current money laundering law and cyberlaundering. Part IV addresses the underlying policy debate surrounding anonymous digital currency. Essentially, the balance between individual financial privacy rights and legitimate law enforcement interests. In conclusion, Part V raises a few unanswered societal questions and attempts to predict the future.

Disclaimer:

Although the author discusses this subject in a casual, rather than rigidly formal tone, money laundering is a serious issue which should not be taken lightly. As this article will show, fear of money laundering only serves to increase banking regulations which, in turn, affect everyone's ability to conduct convenient, efficient and relatively private financial transactions.

Part I Humble Beginnings

In the beginning, laundering money was a physical effort. The art of concealing the existence, the illegal source, or illegal application of income, and then disguising that income to make it appear legitimate[1] required that the launderer have the means to physically transport the hard cash.[2] The trick was, and still is, to avoid attracting unwanted attention, thus alerting the Internal Revenue Service (IRS) and other government agencies[3] involved in searching out ill-gotten gains.[4]

In what could be described as the "lo-tech" world of money laundering, the process of cleaning "dirty money" was limited by the creative ability to manipulate the physical world. Other than flying cash out of one country and depositing it in a foreign bank with less stringent banking laws,[5] bribing a bank teller, or discretely purchasing real or personal property, the classic approach was for a "smurf"[6] to deposit cash at a bank. Essentially, platoons of couriers assaulted the lobbies of banks throughout the United States with deposits under the $10,000 reporting limit as required under the Bank Secrecy Act.[7] The result was the formation of a serious loophole under the Bank Secrecy Act, allowing couriers almost limitless variables in depositing dirty money such as the number of banks, the number of branch offices, the number of teller stations at one branch office, the number of instruments purchased, the number of accounts at each bank, and the number of persons depositing the money.

In 1986, the Money Laundering Control Act (the Act)[8] attempted to close the loopholes in the prior law that allowed for the structuring of transactions to flourish.[9] In criminalizing the structuring of transactions to avoid reporting requirements, Congress attempted to "hit criminals right where they bruise: in the pocketbook."[10] Under the Act, the filing of a currency transaction report (CTR)[11] is required even if a bank employee "has knowledge" of any attempted structuring.[12] Thus, it appeared as if the ability to launder the profits from illegal activity would be severely hampered.

As the physical world of money laundering began to erode, the tendency to use electronic transfers to avoid detection gained a loyal following. Electronic transfers of funds are known as wire transfers.[13] Wire transfer systems allow criminal organizations, as well as legitimate businesses and individual banking customers, to enjoy a swift and nearly risk free conduit for moving money between countries.[14] Considering that an estimated 700,000 wire transfers occur daily in the United States, moving well over $2 trillion, illicit wire transfers are easily hidden.[15] Federal agencies estimate that as much as $300 billion is laundered annually, worldwide.[16] As the mountain of stored, computerized information regarding these transfers reaches for the virtual stars above, the ability to successfully launder increases as the workload of investigators increases.[17]

Although wire transfers currently provide only limited information regarding the parties involved,[18] the growing trend is for greater detail to be recorded.[19] If the privacy of wire transfers is compromised, due to burdensomely detailed record keeping regulations,[20] electronic surveillance of transfers, or other potentially invasionary[sic] tactics,[21] then the leap from the physical to the virtual world will be nearly complete. If laundering is to survive it must expand its approach, entering the world of cyberspace.

While change is often a frighteningly awkward experience, for an enterprising criminal operation, that wishes to remain open for business, it is a necessity. As the above mentioned race through laundering history demonstrates, creativity, and not necessarily greed, has been the launderer's salvation. The recent explosion of Internet access[22] may be the new type of detergent which allows for cleaner laundry.

Part II Enter, Anonymous Ecash

In the virtual universe of cyberspace the demand for efficient consumer transactions has lead to the establishment of electronic cash.[23] Electronic cash, or digital money, is an electronic replacement for cash.[24] Digital cash has been defined as a series of numbers that have an intrinsic value in some form of currency.[25] Using digital cash, actual assets are transferred through digital communications in the form of individually identified representations of bills and coins - similar to serial numbers on hard currency.[26][27] While the ultimate goal of each vendor is to facilitate transactional efficiency, bolster purchasing power on the Internet, and, of course, earn substantial profit in a new area of commerce, each vendor plays by slightly different rules.[28] Although the intricacies of individual vendors are quite fascinating, for the purpose of this article, it is fair to say that all but one vendor have one trait in common: lack of anonymity.

The exception to the general rule of lack of anonymity is DigiCash.29 Digicash is an Amsterdam-based company created by David Chaum,30 a well respected cryptologist. DigiCash's contribution to Internet commerce is an online payment product called "ecash."31 According to DigiCash, electronic cash by DigiCash "combines computerized convenience with security and privacy that improve on paper cash."32 Ecash is designed for secure payments from any personal computer to any other workstation, over e-mail or Internet.33 In providing security and privacy for its customers, DigiCash uses public key digital blind signature techniques.34 Ecash, unlike even paper cash, is unconditionally untraceable. The "blinding" carried out by the user's own device makes it impossible for anyone to link payment to payer. But users can prove unequivocally that they did or did not make a particular payment, without revealing anything more.35 While ecash's security technology may be among the best in the business as of this writing, the focus of this article is upon one aspect of DigiCash that is of particular interest to money launderers and law enforcement: Anonymity.

Endnotes

These are essential to fully understand the article!

- ↑ For a good background on money laundering see Sarah N. Welling, Comment, Smurfs, Money Laundering and the Federal Criminal Law, 41 Fla. L. Rev. 287, 290 (1989).

- ↑ In this article, "hard cash or currency" refers to any non-Internet-based money. As an illustration of hard cash, a suitcase filled with $1million worth of $20 bills weighs more than 100 lbs. See Business Week, Money Laundering, March 18, 1985.

- ↑ The United States Department of the Treasury has created a technology-based law enforcement unit called Financial Crimes Enforcement Network (FinCen). FinCen has been delegated the job of oveerseeing[sic] and implementing policies to prevent and detect money laundering. See FinCen at URL: http://www.ustreas.gov/treasury/bureaus/fincen.facts.html.

- ↑ While the profits from sales of illegal narcotics is the most common and widely publicized example of "dirty money," the gains from illegal gambling, prostitution, extortion, and essentially any illegal activity are a suspect classification. See H.R. Rep. No. 975, 91st Cong., 2d Sess. 11, reprinted in 1970 Code Cong. & Admin. News 4394, 4396.

- ↑ Traditional non-U.S. hotspots for laundering include, but are not limited to, Switzerland, Panama, Bahamian Islands and Luxembourg. However, recently, even the Swiss have been turning away deposits from suspected illegal gains. See Swiss bankers changing rules, St. Pete. Times, Oct. 10, 1995, at 17A & 24A.

- ↑ Courriers[sic] who scurry from bank to bank to conduct multiple cash transactions under the $10,000 reporting limit. The name "smurf" is from the hyperactive blue cartoon characters that seemed to be everywhere at once.

- ↑ 31 C.F.R. sect. 103.22(a)(1) (requirement that a currency transaction report (CTR) be filed for "transactions" of more than $10,000). The Bank Secrecy Act itself is contained at 18 U.S.C. sects. 1956-1957 (1970). It incorporates related statutes such as 31 C.F.R. sect. 103.22.

- ↑ Money Laundering Control Act of 1986, Pub. L. No. 99-570, Title I, Subtitle H, sects. 1351-67, 100 Stat. 3207-18 & 3207-39 (1986) (codified as amended at 18 U.S.C. sects. 1956-1957 (1988 & Supp. V 1993)).

- ↑ 18 U.S.C. sect. 1956(a)(1) criminalizes structuring and attempted structuring of financial transactions so as to avoid reporting requirements. The reporting requirements are set forth in 31 C.F.R. sect. 103.22.

- ↑ H.R. Rep. No. 855, 99th Cong., 2d Sess. 13 (1986).

- ↑ A CTR is a transactional report which may include the date and time of the transaction, the amount involved and certain information regarding the identity of the originator and the beneficiary of the transaction. See 31 U.S.C. sect. 5313 (1988); 31 C.F.R. sect. 103.22 (1988).

- ↑ 18 U.S.C. sect. 1956(a) (based upon the text, actual subjective knowledge that the money used in the transaction was derived from an unlawful source, rather than what should have been known is the standard to be applied). See 31 C.F.R. sect. 103.22(a)(1) (1988) ("Has knowledge" is defined as pertaining to that of a partner, director, officer or employee of a financial institution or on the part of any existing system at the institution that permits it to aggregate transactions).

- ↑ A wire transfer is simply the transfer of funds by electronic messages between banks. U.C.C. Article 4A Prefatory Note (1991) defines a wire transfer as "a series of transactions, beginning with the originator's payment order, made for the purpose of making payment to the beneficiary of the order."

- ↑ There are three major electronic funds transfer systems: (1) SWIFT: the Society for Worldwide Interbank Financial Telecommunication, is a Belgian-based association of banks that provides the communications network for a large number of international funds transfers, as well as intracountry transfers within the United States; (2) CHIPS: the Clearing House Interbank Payments System, is a funds settlement system operated by the New York Clearing House; and (3) Fedwire: the funds transfer system operated exclusively by the Federal Reserve System.

- ↑ See Office of Technology Assessment, Congress of the United States, Information Technology for the Control of Money Laundering, iii (1995) (OTA-ITC-630).

- ↑ Id. at 2.

- ↑ In 1994, the number of CTRs was approximately 10,765,000. The IRS, who is in charge of checking on suspicious transactions, does not have enough investigators to consistently check these reports. However, FinCen, in its desire to keep the IRS up to speed, is currently attempting to process every CTR by means of its artificialintelligence[sic] system. See Id. at 6-7.

- ↑ See supra note 11 for a brief explanation of the limited contents of a CTR.

- ↑ As a result of the Money laundering Suppression Act of 1994, an additional form will be required for suspect transfers. If it currently cost a bank between $3 to $15 to file a CTR, the cost will only increase as additional forms are required. See Office of Technology Assessment, supra note 15 at 7.

- ↑ In addition to the information contained on a CTR, a financial institution may be required to retain either the original or a copy of both sides of the monetary instrument for a period of five years. 31 C.F.R. sect. 103.38.

- ↑ "Using evidence from the first court-ordered wiretap on a computer network, federal agents have charged an Argentine student with hacking his way into the U.S. military and NASA computers." WiretapSnares Hacker Who Raided Defense Net, Chicago Trib., March 29, 1996, at 1. (This could just as easily be performed on wire transfer system).

- ↑ Twenty-five million Americans had Internet access in early 1995. See Legal Issues in the World of Digital Cash, available online at URL: http://www.info-nation.com/cashlaw.html/.

- ↑ Electronic Cash, digital cash, digital currency and cybercurrency are synonyms for an electronic medium of exchange which has no intrinsic value, and the barest trace of physical existence. See Daniel C. Lynch & Leslie Lundquist, Digital Money: the new area of Internet commerce, 1996 at 99.

- ↑ Id. at 99.

- ↑ David Cline, Term Paper, Cryptographic Protocols for Digital Cash, George Washington University, School of Engineering and Applied Science (Computer Security I). Available online at URL: http://www.seas.gwu.edu/student/clinedav/.

- ↑ Information Infrastructure Task Force, The Report of the Working Group on Intellectual Property Rights, Intellectual Property on the National Information Infrastructure, 193 (Sept. 1995). Available online at URL: http://www.uspto.gov/web/ipnii (PDF format); and URL: gopher://ntian1.ntia.doc.gov:70/00/papers/documents/files/ipnii.txt (ASCII format).

Citenote missing in original document

- ↑ See Lynch & Lundquist, supra note 23 at 24, table 2.1.

- ↑ See Lynch & Lundquist, supra note 23 at 37, table 2.2.